ABOUT US

Rodger Deevers

Series 7, 24, and 66

Financial Advisor

Office: 541.653.9902

Cell: 541.206.8406

Deevers & Sons. We have been in Eugene, Oregon for over 30 years. Since inception we have focused on growing wealth over time for clients. Our father, who started Deevers & Sons, was committed to creating a legacy for his family and chose to dedicate his life to helping clients.

My brother Gary and I were fortunate to join our father in the Deevers & Sons business. There are many good things that run deep in the Deevers family like humor, honor, loyalty, but nothing quite as deep as service. Being of service to others is as much a part of life as breathing, eating, sleeping and Oregon Duck football. After my father served in the US Navy, he built a business serving beloved clients and his community.

After my honorable discharge from the Air Force, I became securities licensed and was fortunate enough to work side-by-side with him until his death in 2008, when my brother, and I picked up the mantle and took on the challenge of carrying forward a legacy of service. I have a wonderful wife, Lisa, and three children, Mack, Joshua, and Noah. Both Joshua and Noah are Autistic and much of my time away from my work responsibilities is spent on Board of Directors duties of Joshua’s independent living company, or volunteering and coaching Special Olympics activities with my son Noah.

For additional information about an investment adviser representative, including licenses and state registrations, please visit www.BrokerCheck.com.

How do we help clients grow wealth over time?

We plan with purpose. We believe your strategy should be determined by your financial goals. Our process is focused on getting to the heart of your objectives first, so that we can offer a investment strategy that aligns with- and supports- your vision.

Phase 1: Relationship Building

Relationships are everything at Deevers & Sons. Our commitment is to get to know you and understand your goals and circumstances, so that we can make comprehensive financial recommendations.

Phase 2: Information & Data Gathering

After getting to know you, our focus turns to your current financial circumstances. With your assistance, we will endeavor to create a complete picture of your finances.

Phase 3: Analyze & Evaluate

Once we understand where you want to be in the future and have an understanding of what your financial situation looks like today, we will develop a plan to guide you toward your financial future.

Phase 4: Presentation of Your Plan

In this phase, we will present you with the recommendations and scenarios we have identified for you. We will also educate you on the benefits and drawbacks of each. We believe an informed investor is an empowered investor.

Phase 5: Implementation of Your Plan

This is “go” time when we work together to put your plan into action. We will keep you informed and updated on progress.

Phase 6: Staying on Track

Circumstances can and will change for clients. If you think it might be time to make changes, we can revisit your objectives to help keep you on track.

Our Approach to Investment Selection

Focused on Your Lifecycle Needs

At Deevers & Sons, we work with you to determine the method of investing most appropriate to meet your goals based on your unique circumstances and personal objectives. We have the tools to assist you throughout each stage of your “investing lifecycle.”

At Deevers & Sons, we choose from carefully selected solutions to help you meet the needs of your investment plan as you move through the investing lifecycle.

By working with your advisor, you will be able to identify the investment options that most align with your personal goals, time horizon, risk tolerance, and investing preferences. You can always adjust your investment plan and to accommodate changing needs.

Professional Asset Management

Through the Primerica Advisors LifeGme Investment Program, we offer professionally managed investment strategies. The asset managers are selected based on their demonstrated ability to develop and manage investments that can assist clients in meeting their accumulation, preservation, and distribution goals.

Primerica identifies professional asset managers based on:

- Organizational structure and credentials of the people focused on managing the assets

- Asset manager’s defined philosophy and process

- Asset manager’s ability to deliver repeatable, consistent performance

Asset Allocation and

Investment Model Offerings

At Deevers & Sons, we believe a well-designed and executed asset allocation is a key component to helping you achieve your long-term goals.

Asset allocation might be beneficial in achieving the appropriate balance or “risk and return” objectives. It is important to consider spreading your assets across different asset classes, sectors, and market themes.

Your advisor will work with you to determine which investment options are appropriate to be part of your asset allocation. Your asset allocation may differ depending on your need for growth, income generation, preservation, or income distribution.

Simplicity

At Deevers & Sons, we believe that simplicity and ease of review of assets is important in helping you track your progress.

We make it simple for you to monitor, manage and make changes to your account when necessary.

Performance reports provide clear and

concise information about your investments. These reports give you and your Primerica advisor the opportunity to review your account holdings and determine whether your investments continue to reflect your needs.

Commitment to Service and Adding Value

Gary Deevers

Series 6, 63, 65

Financial Advisor

Office: 541.653.9902

Cell: 541.632.0111

I can remember when I began helping my father around the office back in 1992 while I was still in high school. The more I was able to be around him in this business, his passion became more evident. Since his passing it has been my pleasure to lead our service initiative for clients.

We pride ourselves on providing exemplary customer service and are committed to being available to assist you whenever the need arises.

When you work with Deevers & Sons, you can be assured of having a relationship that is providing you value. We commit to:

- Helping you simplify the complexities of retirement planning.

- Offering a holistic approach during your investment lifecycle.

- Helping you articulate and, define your financial goals.

- Earning your trust through transparency and straightforward communication.

- Offering a wide range of investment options to help serve your investment needs.

For additional information about an investment adviser representative, including licenses and state registrations, please visit www.BrokerCheck.com.

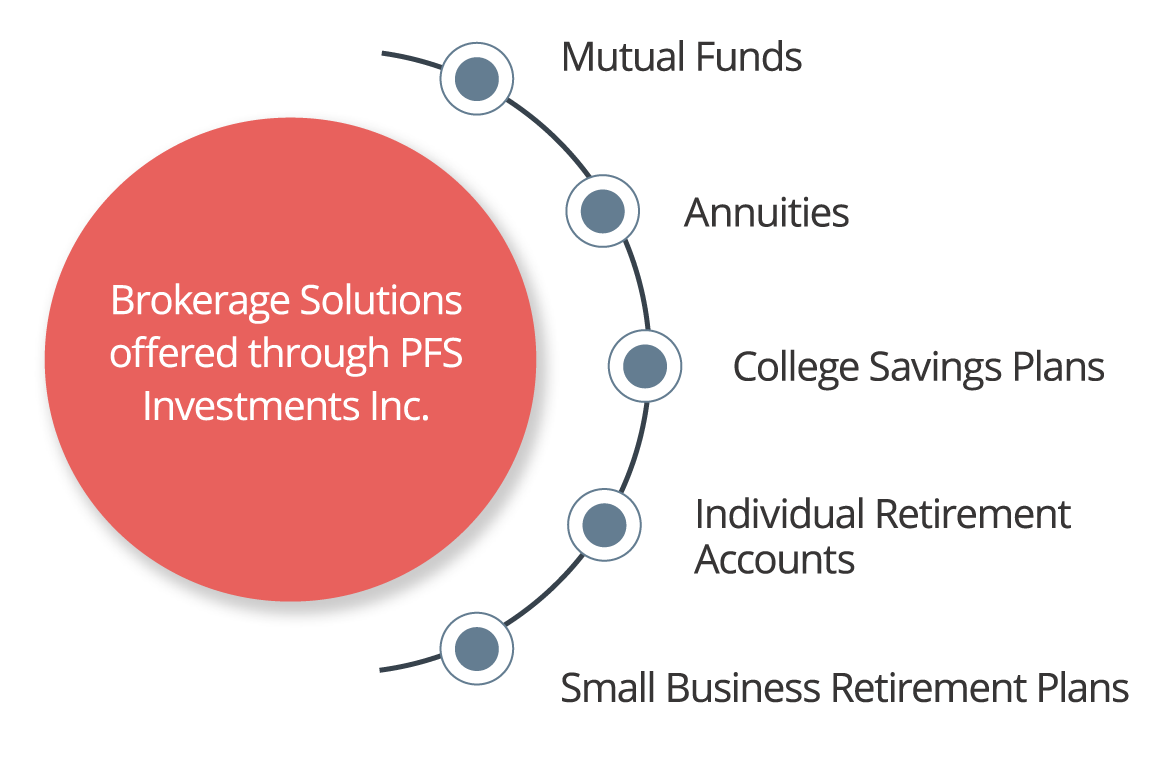

Managed Accounts offered through Primerica Advisors

Primerica Advisors Lifetime Investment Program

Focused on the client’s investment needs: The Primerica Advisors Lifetime Investment Program is designed to enable advisors to assist clients in achieving goals throughout the client’s investing lifecycle. Advisors can assist clients through the accumulation, preservation and income distribution phases of their lives.

Access to professional asset managers: The program provides access to professional asset managers who have established track records in asset allocation and security selection using exchange traded funds, mutual funds, and individual stocks and bonds. Each asset manager is selected based upon the quality of their people, philosophy, process and performance.

Primerica Advisors Lifetime Investment Program

Individuals identified as Deevers & Sons are are affiliated with PFS Investments Inc., a subsidiary of Primerica, Inc., and offer products and services through PFS Investments Inc.

A Primerica representative’s ability to offer products and services is based on the licenses held by the individual, and the states in which the individual is registered. Not all representatives are authorized to sell all products and services. For additional information about a representative, including licenses and state registrations, please visit www.BrokerCheck.com.

PFS Investments Inc. (PFSI) offers brokerage and advisory services. Representatives do not have investment discretion over any client account or assets. For additional information about the products and services available from PFSI, including fees, expenses and the compensation received by PFSI and your representative, please review a copy of our Form CRS, Form ADV brochure and our informational brochure, Investing with Primerica, available from your representative and online at www.primerica.com/pfsidisclosures.

PFSI, 1 Primerica Parkway, Duluth, Georgia 30099-0001, registered broker-dealer and investment adviser, member of FINRA/SIPC. PFSI offers advisory services through and is the sponsor of the Primerica Advisors Lifetime Investment Program. Primerica Brokerage Services, Inc. (PBSI), member of FINRA/SIPC, is the provider of brokerage services for the Primerica Advisors Lifetime Investment Program. Representatives who offer advisory services are supervised persons of PFSI, and are not associated persons of PBSI. Primerica, Inc., PFSI and PBSI are affiliated companies.

The Lifetime Investment Program is an advisory program sponsored by PFSI under the name Primerica Advisors. For additional information about Primerica Advisors, please ask your representative for a copy of the Lifetime Investment Program Form ADV brochure.

Mutual funds, annuities, 529 plans, 401(k) plans and asset managers referenced above are made available through contractual relationships between PFSI and the product providers.

Before investing, you should carefully consider your financial objectives, and the risks, charges, fees and expenses associated with any investments you are considering. This and other important information can be found in the prospectus and the summary prospectus, if available. Please review prospectuses, sales literature and other disclosures carefully before investing. Prospectuses are available from your Primerica representative.

Primerica representatives are not estate planners, or tax advisors. For related advice, individuals should consult an appropriately licensed professional.

This material is for informational purposes only and should not be considered investment advice or a recommendation to buy, sell or hold a security.

Investing entails risk including loss of principal. Past performance is no guarantee of future results.

Location

1000 Willagillespie Road

Suite 100

Eugene, OR 97401